The Purpose Of Recording An Allowance For Uncollectible Accounts Is To . The allowance for doubtful accounts or allowance for uncollectible accounts is a general ledger contra account associated with the current. The allowance for doubtful accounts is a contra asset account and is subtracted from accounts receivable to determine the net realizable. The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though companies may. An allowance for bad debt is a valuation account used to estimate the amount of a firm's receivables that may ultimately be. The entry to record the recovery involves two steps: (1) a reversal of the entry that was made to write off the account, and (2) recording the cash collection on the account: The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. The purpose of making an allowance for bad debts is to try to guess the total amount of bad debts that you're likely to incur during the.

from www.bartleby.com

The allowance for doubtful accounts is a contra asset account and is subtracted from accounts receivable to determine the net realizable. The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. (1) a reversal of the entry that was made to write off the account, and (2) recording the cash collection on the account: An allowance for bad debt is a valuation account used to estimate the amount of a firm's receivables that may ultimately be. The purpose of making an allowance for bad debts is to try to guess the total amount of bad debts that you're likely to incur during the. The entry to record the recovery involves two steps: The allowance for doubtful accounts or allowance for uncollectible accounts is a general ledger contra account associated with the current. The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though companies may.

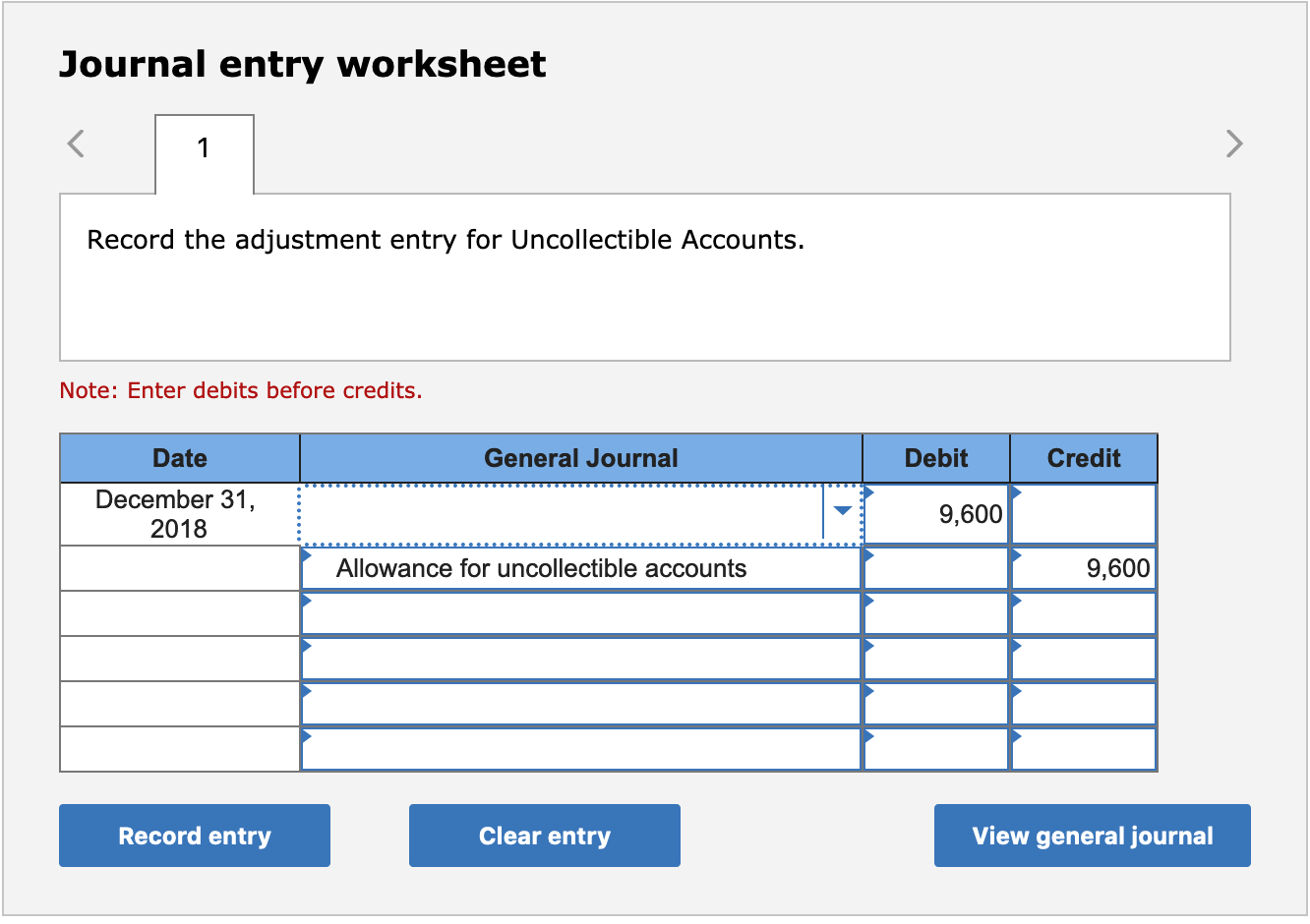

Answered Journal entry worksheet Record the… bartleby

The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The purpose of making an allowance for bad debts is to try to guess the total amount of bad debts that you're likely to incur during the. The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. An allowance for bad debt is a valuation account used to estimate the amount of a firm's receivables that may ultimately be. The purpose of making an allowance for bad debts is to try to guess the total amount of bad debts that you're likely to incur during the. The allowance for doubtful accounts or allowance for uncollectible accounts is a general ledger contra account associated with the current. (1) a reversal of the entry that was made to write off the account, and (2) recording the cash collection on the account: The allowance for doubtful accounts is a contra asset account and is subtracted from accounts receivable to determine the net realizable. The entry to record the recovery involves two steps: The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though companies may.

From www.coursehero.com

[Solved] Johnson Company calculates its allowance for uncollectible The Purpose Of Recording An Allowance For Uncollectible Accounts Is To An allowance for bad debt is a valuation account used to estimate the amount of a firm's receivables that may ultimately be. The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. The purpose of making an allowance for bad. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From slideplayer.com

LESSON /14/2018 LESSON 144 Planning and Recording an Allowance for The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. The allowance for doubtful accounts is a contra asset account and is subtracted from accounts receivable to determine the net realizable. The purpose of making an allowance for bad debts. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From www.solutionspile.com

[Solved] Required 1. Record the adjusting entry for unco The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The purpose of making an allowance for bad debts is to try to guess the total amount of bad debts that you're likely to incur during the. The allowance for doubtful accounts or allowance for uncollectible accounts is a general ledger contra account associated with the current. The entry to record the recovery involves two steps: The allowance for doubtful. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From www.youtube.com

Intro to the Allowance Method and Uncollectible Accounts (Financial The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts is a contra asset account and is subtracted from accounts receivable to determine the net realizable. The allowance for doubtful accounts or allowance for uncollectible accounts is a general ledger contra account associated with the current. (1) a reversal of the entry that was made to write off the account, and (2) recording the cash. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From www.youtube.com

Allowance Method for Uncollectible Accounts Principles of Accounting The Purpose Of Recording An Allowance For Uncollectible Accounts Is To (1) a reversal of the entry that was made to write off the account, and (2) recording the cash collection on the account: The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though companies may. The allowance for doubtful accounts or allowance for uncollectible accounts is a general ledger contra. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From slideplayer.com

LESSON /14/2018 LESSON 144 Planning and Recording an Allowance for The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts is a contra asset account and is subtracted from accounts receivable to determine the net realizable. (1) a reversal of the entry that was made to write off the account, and (2) recording the cash collection on the account: The allowance for doubtful accounts is a contra account that records the percentage of receivables expected. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From www.personal-accounting.org

Allowance for Uncollectible Accounts Personal Accounting The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts or allowance for uncollectible accounts is a general ledger contra account associated with the current. The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though companies may. The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From tr.ebrdbusinesslens.com

Tahsil Edilemeyen Hesapları Kaydetme Ödeneği Yöntemi Muhasebe 2024 The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. (1) a reversal of the entry that was made to write off the account, and (2) recording the cash collection on the account: The allowance for doubtful accounts is a. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From saylordotorg.github.io

Accounting for Uncollectible Accounts The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The entry to record the recovery involves two steps: The allowance for doubtful accounts or allowance for uncollectible accounts is a general ledger contra account associated with the current. The allowance for doubtful accounts is a contra asset account and is subtracted from accounts receivable to determine the net realizable. The purpose of making an allowance for bad debts is. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From slideplayer.com

ALLOWANCE METHOD OF RECORDING LOSSES FROM UNCOLLECTIBLE ACCOUNTS ppt The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though companies may. An allowance for bad debt is a valuation account used to estimate the amount of a firm's receivables that may ultimately be. The purpose of making an allowance for bad debts is to try to guess the total. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From www.double-entry-bookkeeping.com

Allowance Method for Uncollectible Accounts Double Entry Bookkeeping The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though companies may. The entry to record the recovery involves two. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From slideplayer.com

Allowance Method of Recording Uncollectible Accounts Expense ppt download The Purpose Of Recording An Allowance For Uncollectible Accounts Is To (1) a reversal of the entry that was made to write off the account, and (2) recording the cash collection on the account: An allowance for bad debt is a valuation account used to estimate the amount of a firm's receivables that may ultimately be. The allowance for doubtful accounts is a contra asset account and is subtracted from accounts. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From accountingmethode.blogspot.com

Uncollectible Accounts Receivable Example Accounting Methods The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. The purpose of making an allowance for bad debts is to try to guess the total amount of bad debts that you're likely to incur during the. The allowance for. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From www.chegg.com

Solved 1. Record the adjusting entry for uncollectible The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts or allowance for uncollectible accounts is a general ledger contra account associated with the current. The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though companies may. The purpose of making an allowance for bad debts is to try to guess the total amount of. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From www.chegg.com

Accounting Archive October 22, 2017 The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The allowance for doubtful accounts is a contra asset account and is subtracted from accounts receivable to determine the net realizable. The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. The purpose of making an allowance for bad debts. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From slideplayer.com

LESSON 141 Distributing Corporate Earnings to Stockholders ppt download The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The entry to record the recovery involves two steps: The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though companies may. (1) a reversal of the entry that was made to write off the account, and (2) recording the cash collection on the account: The purpose of making an allowance. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From www.bartleby.com

Answered Journal entry worksheet Record the… bartleby The Purpose Of Recording An Allowance For Uncollectible Accounts Is To (1) a reversal of the entry that was made to write off the account, and (2) recording the cash collection on the account: The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. The allowance for doubtful accounts is a. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.

From slideplayer.com

LESSON /14/2018 LESSON 144 Planning and Recording an Allowance for The Purpose Of Recording An Allowance For Uncollectible Accounts Is To The purpose of making an allowance for bad debts is to try to guess the total amount of bad debts that you're likely to incur during the. The allowance for doubtful accounts is an example of a “ contra account,” one that always appears with another account but as a direct reduction to lower the reported value. An allowance for. The Purpose Of Recording An Allowance For Uncollectible Accounts Is To.